Guide to Proof of Address (PoA): Definition, Uses, and More

What is the one thing common in verifying customer details, maintaining compliance, and onboarding new clients? All these require proof of address to prevent fraud, ensure compliance, and maintain the integrity of the business operation.

But what is proof of address? So many “proof of” terms are thrown around by banks and utility companies. This mandates clarity on the concept of proof of address.

This blog discusses proof of address in detail. We will break down the definition, explore its uses, and highlight the common documents used as proof of address. We will also look into some verification best practices that organizations should follow to ensure address accuracy.

Key Takeaways

- A proof of address confirms the person’s identity and their legitimate address. This helps mitigate fraud, identity theft, and financial crimes.

- Various industries including financial services, utilities, and government agencies require proof of address for identity verification and to comply with regulations like KYC and AML.

- Some of the most commonly accepted proof of address documents are utility bills, bank statements, and rental agreements.

- Verifying proof of address demands clear guidelines, proper communication with customers, and enforcing both manual and software-based address verification.

What is a Proof of Address (PoA)?

When an organization has to confirm the current address of a person, they demand a proof of address (POA) document. It shows the authority that the person lives at the address where they claim to. It generally includes the full name and the complete current residential address. There are various forms of proof of address documents such as utility bills, government correspondence, bank statements, etc.

Difference Between Proof of Address (PoA), Proof of Residence (PoR), and Proof of Identity (PoI)

While they might look similar, they serve different purposes. We will understand the difference with examples of documents.

As mentioned above, proof of address shows where the person lives currently. Anything that has the individual’s complete name and address can be used as proof of address. It is demanded by service providers that need the current location of the person, such as opening a new bank account or applying for a credit card. Examples of proof of address include utility bills, bank statements, and lease agreements.

A PoR is a document that shows where the person has been residing for a long time. It can be shown through a mortgage contract, property tax statement, or rental agreement. It is used when a person wants to register for voting, in the immigration process. It is also needed in legal matters that require the individual to disclose where they live permanently or legally.

A PoI is a document that confirms who the person is, mainly through photos and personal information. An ID Card, birth certificate, or driver’s license can be used to prove the identity. Unlike the other two, it confirms the identity and not the location. It can be required in many situations like applying for a job or travelling internationally.

Why is a Proof of Address Required?

Whether opening a bank account, applying for a loan, or registering for a government service, most providers require customers to submit proof of address for the following reasons.

Compliance

Certain organizations like banks, and cryptocurrency companies have to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Hence, they collect the proof of address as a part of their risk-based procedure to verify a customer’s identity. Moreover, establishments like insurance companies have geographical constraints because of the licensing requirements and local laws. They need proof of address to adhere to these laws.

Prevent Fraud

Fraud, money laundering, and identity theft have become a widespread problem. To prevent these and other financial crimes, it is mandatory in the US to provide proof of address under the Customer Identification Program (CIP). It guarantees that the individual applying for the service is who they purport to be. With a legitimate, traceable address, proof of address protects both the individual and the organization from identity theft, false claims, or any misuse of the service.

Effective Communication

Aside from preventing any illegal activity, these types of documents also ensure that the official correspondence reaches the right location. Banks, insurance companies, or government agencies need reliable addresses to send bills or legal documents. Moreover, in case of emergency, like a legal dispute or need for urgent medical care, the proof of address ensures that the organization can reach the person.

Impact of Proof of Address on a Business

Customer Onboarding

Verification of address upfront streamlines the onboarding process. It ensures that all the necessary documentation is collected and verified in the beginning. Moreover, it helps in maintaining accurate records which might be crucial for future communication. Furthermore, quick verification can ensure expedited service activation. This can enhance the customer experience as they will appreciate quick service and a reduced waiting period.

Customer Relationship Management

Having an accurate address can help a business deliver tailored services and communication based on the customer’s location. Moreover, it also makes issue resolution efficient. If a customer has a query or is facing an issue, the business can ensure quick, localized support. This will enhance the customer experience.

How Does Proof of Address Work?

Organizations might need the customer to visit their local office or a branch along with physical copies of the document to verify their current address. Some companies might send a code to the address. Upon receiving it, the person can proceed with the verification process on an online portal.

Common Uses of PoA

Banking

When opening a new bank account, financial institutions require proof of address to ensure that the account holder resides at the place they are mentioning in the application. This prevents the possibility of fraud or impersonation. Moreover, a valid and verified address also allows banks to send confidential information securely. It minimizes the chance of the information being intercepted or sent to the wrong recipient.

Utility Set-Up

When setting up electricity, water supply, or an internet connection, the utility company might ask for proof of address. This is done to ensure timely delivery of service and correct billing. Moreover, address verification through a proof of address document also helps utility companies confirm whether or not they serve in a particular zone.

Employee Verification

Employers need it as a part of candidate verification. It helps ascertain that the person is actually who they are claiming to be. Moreover, it is also needed to comply with the legal and tax requirements. Employers can use it to report earnings, withhold taxes, and ensure compliance.

It plays a crucial role in determining which state or local tax laws apply to the employee. Furthermore, it also leaves no room for potential fraud. It helps find out whether the employee is lying about living in a certain area to receive certain benefits.

Government Service

People planning to use government services like getting a driver’s license or registering to vote might have to submit proof of address to the state or national authority. It helps confirm that the person is living in the jurisdiction where they are applying services for.

Some government agencies are made for financial assistance to the citizens such as social welfare. Proof of address will prevent misuse of such services, such as applying for benefits in multiple states. Moreover, eligibility for social services is dependent on the location. A proof of address ensures fair and accurate distribution of benefits.

Rental Agreements

Landlords ask for proof of address from the tenants when signing a rental agreement for several reasons. Aside from verification, it helps the landlord assess the tenant’s rental history. The proof of address helps cross reference with the previous landlords to confirm that the tenant is reliable, and punctual in payments. Moreover, regions with strict laws require landlords to collect proof of address to ensure compliance. It ensures that both parties have a documented and transparent rental agreement.

Also Read: What is Address Lookup?

Also Read: What is Address Lookup?What Makes a Proof of Address Valid?

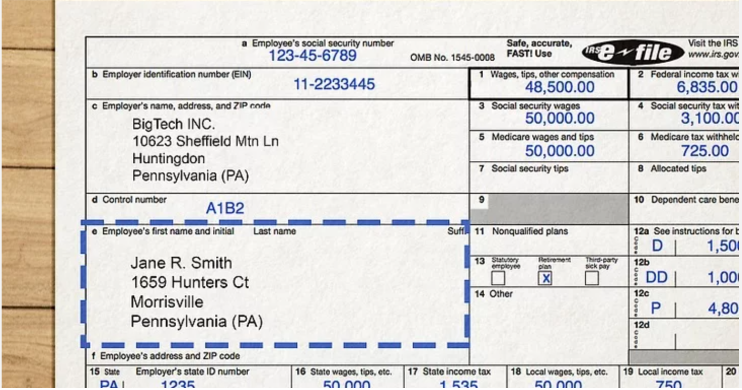

The following criteria make a proof of address valid and acceptable by authorities like banks.

- It should mention the full name.

- It should have the current residential address.

- The name should match with the government-issued identification document.

- The document must be issued by a recognized authority. It should have their name, logo, and address. For example, a document issued by a government agency or a judicial authority will work.

A proof of address sample is shown below. You can see that it has the person’s full name with a complete address. Moreover, it is issued by the IRS, a credible organization.

What is Not Accepted as Proof of Address?

The type of document that will be accepted as proof of address varies according to the legal and regulatory requirements. However, certain common factors make it unacceptable.

- A document that only has the address and not the full name will not considered. It needs the name to verify the identity as well.

- Avoid showing digital bills as not many institutions consider them valid. People who have gone paperless can request a physical copy from the utility service provider.

- Certain organizations might not accept documents older than 3 months. It’s advised to check the period of relevance with the authorities.

- Institutions like banks do not accept photocopies. As a general rule of practice, regardless of the organization, always carry original documents.

- Any informal correspondence like a handwritten letter from friends or family will not be accepted.

- Documents that only list the P.O. Box instead of the complete address will not be considered.

- Printed online documents that do not have the company’s logo or watermark are not acceptable.

- Any work ID or badges will be accepted. While they may verify employment, they do not confirm the address.

Some authorities do not allow the use of the same document for proof of address and proof of identity. Furthermore, a person younger than 18 years old might have to submit a proof of address issued to their parents.

Documents That Can be Used as PoA

- A recent utility bill with the name and address printed on it. It can be an electricity, phone, gas, or water bill. Ensure that the records are from the last 3 months. In situations where there is no recent bill, a signed letter from the social service agency or the landlord can confirm the address.

- A monthly bank statement or any recent official correspondence from the bank. Customers must ensure that it mentions transactions from the last 12 months. Individuals who have opted for an online statement instead of by post can request a paper version by mail.

- A correspondence document from the government agency. It can be a tax statement or a social security letter.

- A rental agreement mentioning the current address.

- A homeowner can submit a mortgage statement that has their name and complete address on it.

- Any insurance policy that has the policyholder’s name and current address on it, such as home insurance, car insurance, or a health insurance document.

- Students can use their official school enrollment document as proof of address.

- A change of address card can also be used as a proof of address. It can be filled at a local post office, and customers can use the confirmation they receive in the mail as a valid document.

- People living with family can provide proof of address with a family member’s name on it. However, it mandates a proof of relationship for verification.

- A person who has recently moved can register to vote online. They will get a physical copy of the card in their mail. It will have their full name and address, which they can use as a proof of address document.

Best Practices for Proof of Address Verification

Wondering why proof of address needs to be verified, especially when the documents are already used in initial verification? Verifying proof of address is necessary to make sure the information provided is accurate and up to date. It adds a layer of security and further reduces the risk of any fraudulent activities. Furthermore, accurate address ensures that the products and services get delivered to the right address, minimizing failed or misdeliveries and associated costs. Follow the best practices mentioned below to enhance your proof of address verification method.

Lay Down Clear Policies and Guidelines

Create a detailed list of documents that your organization accepts as proof of address. Furthermore, specify the timeframe in which they should have been issued to ensure the address is current.

Ensure Compliance

Make sure your proof of address verification process adheres to KYC and AML guidelines. This will ensure your records are accurately maintained and you are always prepared for audits. Moreover, to ensure the confidentiality of the customer information, ensure that the process takes place per industry standards and protocols such as CCPA, and SOC-II.

Establish Clear Communication With Customers

Provide customers with clear guidelines on which documents will be accepted and how to submit them. This will minimize any delay and confusion during the verification process. Moreover, make the process convenient for the customers by allowing submission of proof of address through multiple channels such as email, in-person, or online portal.

Keep the Address Database Updated

Customers might change their address frequently. This can render the previously submitted proof of address useless. To ensure the database has current information, set an expiry date on the documents. Inform the customers of their expiring proof of address in advance to ensure the records are accurate and up-to-date.

Train the Staff

Educate the employees on policy changes, and the latest fraud trends to ensure accurate manual verification. Moreover, create a checklist that will guide them through the process. This will ensure no steps are missed during the manual review of documents.

Also Read: How to Address International Mail

Also Read: How to Address International MailImplement Automated Verification Method for Verifying the Addresses

Global business expansion and demand for quick and efficient onboarding have rendered the manual process less efficient. With the advancement in technology, organizations are now using address verification software like PostGrid to confirm whether or not the address exists.

Postgrid offers a comprehensive address verification tool that verifies, validates, standardizes, and autocompletes more than a million addresses as per the postal standards to ensure accuracy. We are CASS (U.S.P.S.) certified. We ensure that the data exists and is deliverable by running it against the United States Postal Service (U.S.P.S.) database. Moreover, we also cross reference addresses with National Change Of Address (N.C.O.A) records to check any recent change of address. Thus, we make sure that the address is accurate and up-to-date.

With real-time address verification, validation and autocomplete at the point of entry we prevent any incorrect or incomplete address from entering the system. With our bulk verification feature, you can verify over 1 million addresses in a single request. Moreover, with in-built tools like geocoding API offering rooftop geocoding, we ensure that the address is verified down to the building and apartment number.

Conclusion

Proof of address is necessary to ensure the person is living at the place where they are claiming to be. It helps businesses stay compliant, prevent fraud, and strengthen customer relationships. Proof of address verification is a crucial step that strengthens the accuracy of the address.

While manual verification has been the norm, using an address verification tool like PostGrid can speed up the process. With features like batch verification and checking the records against USPS and NCOA, we accelerate the verification while maintaining accuracy. Moreover, we adhere to the latest security protocols, ensuring your customer information is processed in a safe and secure environment. Want to see us in action? Request a demo.

Frequently Asked Questions

Is a Postal Letter a Proof of Address?

Yes, a postal letter with the name and address on it is considered a valid proof of address in the United States. Ensure that it is not hand-written.

Can I Get Proof of Address Without Utility Bills?

Yes, instead of utility bills, you can show other documents as proof of address. You can use a bank statement, government-issued ID, insurance papers, or tax records.

Can a Proof of Address be Online?

Yes, you can submit an online proof of address such as an E-statement and online bills.

What is the Easiest Proof of Address?

A driver’s license is one of the easiest ways to get proof of address in the United States. It is also one of the most commonly used ones.

How do I Update my Proof of Address?

You can update proof of address in the United States in the following ways.

- Visit your local post office and request an update on proof of address.

- Visit the online portal of the United States Citizenship and Immigration Service and use the self-service tool.

- Fill out and send the AR-11 form by mail.

- Contact banks, government agencies, and utility companies to inform them of the change of address.

Why is my Proof of Address not Accepted?

There could be multiple reasons for your proof of address not getting accepted such as.

- The document may be outdated.

- The document is issued under someone else’s name or it does not have your full name.

- It could be a form of ID that is not accepted as Proof of Address.