How to Write a Cancellation of Insurance Policy Letter?

An insurance policy is a time-sensitive financial instrument that protects a business from various risks. However, businesses often want to cancel their policies for some reason. This cancellation must be present in writing since policies are contracts.

They must send a proper letter to the insurer giving a written cancellation notice. Each insurance company enforces specific rules and procedures for successful cancellation. Businesses need to follow these rules for successful cancellations.

These processes start with a written policy cancellation letter to the insurer. It helps firms start a dialogue with the insurance company and state the reason for cancellation. This blog will teach you everything about insurance policy cancellation letters.

We will also learn how to write a cancellation letter for an insurance policy. Get ready with your mailer because we will draft an effective insurance cancellation letter.

What is an Insurance Policy Cancellation Letter?

It is a legal document that you must send to the insurance company to notify them that you don’t want to pay premiums or enjoy the benefits of their policy. Generally, all insurance companies allow their clients to cancel their subscriptions to their insurance plans.

However, preparing a written notice of cancellation to the insurer is vital. Policyholders must read the policy documents before drafting a policy cancellation letter.

The insurer will state the cancellation procedures in their documentation. Some companies will even provide the person’s contact information to reach out with your letter. It gives complete clarity about the cancellation process of an insurance policy. You also must acquire a confirmation of the cancellation to cancel the current policy officially.

When to Write a Policy Cancellation Letter?

Writing a cancellation letter for a business is never a light decision. It is a critical decision, especially in today’s risky business environment. Before canceling your existing policy, you must avoid exposing your business or personal finances to risks.

Proper research is necessary before you switch to another insurer. You can start comparing quotes from different companies to get better, more affordable, or more appropriate policies.

Reasons Behind an Insurance Cancellation Letter Format

Each company can have a different reason(s) to cancel its policy. Some of the common reasons are;

- Paying too much on insurance premiums.

- The business type is changing and requires a different coverage.

- The company is moving to another state, and the insurer doesn’t provide coverage in the new location.

- A business is unhappy with the insurer’s services.

- The company wants to combine different policies into an affordable bundled policy.

Why You Must Check the Cancellation Terms?

Ensure your demands are according to the terms of the insurance policy. This step is vital to process a smoother cancellation process without hurdles. Carefully read the terms to determine your rights to cancel your current policy.

Usually, policyholders get up to 14 days from the policy’s effective date to cancel without penalty. However, this duration could differ depending on your agreement with the insurer. For example, more extended policies might ask you to give 30 days’ notice or wait until the policy is up for renewal.

Don’t be ignorant of the cancellation terms. You may lose money if you are careless with your insurance policy cancellation letter. The type of insurance also determines the cancellation terms and policy details. For example, car insurance and life insurance are two different regulations.

Also Read: Credit Union Marketing Trends

Also Read: Credit Union Marketing TrendsWhat are the Risks of Cancelling Your Insurance?

There are four prominent risks for your business if you are canceling your policy;

It Can Expose Your Business to Lawsuits or Other Expensive Risks

You are highly prone to lawsuits and other risks if you don’t have another policy ready after the cancellation. Many companies lose thousands of dollars while showing negligence with their new policy. They practically don’t have any safety net from critical risks.

You Might Create a Coverage Gap by Cancelling an Insurance Policy

A claims-made policy is helpful to cover events from the past. However, a business requires continuous coverage even while switching carriers. Such policies often come with errors, omissions, and professional liability.

You must have active insurance to trigger coverage for an insurable event from the past. Talk to the insurer about getting an optional reporting period (ERP) extension or tail coverage if you want to cancel your policy.

You might Save Money But Weaken Your Insurance Safety Net

We know that saving money on insurance is vital. However, it is an awful decision if it comes at the cost of making your company risk-prone. No financial expert would recommend abandoning a policy just to save money and invite trouble.

Can You Adjust Your Insurance Quotes?

Sometimes, adjusting your coverage to match your requirements is possible without abandoning your policy. For example, you can modify your coverage if your business type changes. Experts always find it better to alter the coverage according to your new situation instead of canceling it.

Things to Include in an Insurance Policy Cancellation Letter

Many business owners believe writing a policy cancellation letter is an intimidating task. However, these days, insurance companies make it pretty easy to cancel policies.

The rules could differ for auto insurance cancellation letters, home insurance cancellation letters, or health insurance cancellation letters.

Here are some critical elements to include in your letter;

- Full Name. The policyholder has the complete authority to cancel the subscription to the insurance plan.

- Insurance Policy Number. Double-check to ensure that you are writing the correct number in your letter.

- Complete Address and Contact Details. You must include these details so the insurance company can contact you to discuss the cancellation.

- Mention the Insurance Company. You must take the name of your insurance company instead of the agent.

- Add the date when you are writing the letter.

- Effective Cancellation Date. Provide an exact date of when you want to cancel the policy.

- Reasons for canceling your insurance policy.

- Refund or Stop Payment Request. Policyholders can request the insurance company to stop deducting automation payments right away. Requesting a refund for the remaining balance if you made advance payments is possible.

Considering all these elements, irrespective of your insurance policy type, is vital. Otherwise, the insurance company might not entertain your cancellation request.

Preparation Before Drafting a Policy Cancellation Letter

Financial experts suggest entrepreneurs plan a smooth transition while abandoning their existing insurance policy. These are a couple of factors to consider to prepare better for the cancellation;

Ensure You Have Another Policy Ready While You Cancel the Existing One

Many companies often make the mistake of leaving their existing policy without getting a new insurance company. It exposes them to multiple threats and risks. These risks could be fatal, especially in today’s competitive environment.

A new policy ready is vital to continue your coverage right away. An online quote engine could be an excellent tool for finding and understanding different policies in the market. Try to understand the different paperwork necessary before buying a new policy or consult with an insurance agent.

There Must be No Gap in Your Coverage of the Business Insurance Policy

It is a fatal mistake to leave a gap in your insurance coverage only to save some money. Even a gap of a couple of days is terrible for your policy. Insurance companies will consider this fact as a negative trait.

Your new insurance rates will also reflect this. Be patient while planning your policy cancellation letter to ensure there’s no gap between the time and date of your policies. Financial experts suggest following this practice to avoid extra charges on insurance premiums.

Consider Upgrading Your Policy Instead of Cancelling It

A business could be unhappy with its current insurance company. However, they could consider changing certain aspects instead of dropping the entire coverage. It saves them a lot of money and keeps the policy active in case of a claim.

Here are some tips to decide between canceling and upgrading;

- Review the coverage.

- Increase the deductibles.

- Review your premiums.

- Reduce payrolls on workers’ compensation.

Effective Methods to Cancel Your Insurance Policy

Business owners can use different methods to abandon their insurance policies. The cancellation process is relatively simple, no matter what the reason is. Consider the following steps;

Call Your Insurance Company

Almost every insurance company will ask you to talk to their agents first. The contact details will be on their application, website, or business card.

It is the fastest way to reach their contact person and discuss cancellation. However, you still need to draft a formal letter to make the decision official.

Mail Your Insurance Policy Cancellation Letter

You must use direct mail to send your insurance letter to your agent’s office or the company. Email communication is ineffective for such official documents. For policy cancellation prefer using direct mail to send letters.

Physically Visit the Insurance Company

You can also drop by the company’s office to complete the paperwork personally. It gives you more convenience to discuss the matter with the insurer. The insurer will also recommend better coverage plans for your situation and needs.

Request the Company to Help You With Cancellation

Some insurance companies provide a convenient cancellation process for clients who will change policies in their favor. The new company can support you through the transition period.

Some business owners even let their insurance policy lapse without sending an official notice. However, never do this because the insurer will continue the billing and report your failure to pay to the credit bureaus. It could negatively affect your credit rating.

Best Practices for Writing a Letter to Get New Policies

Professionals and businesses must know about these best practices before mailing policy cancellation letters;

- Call your insurer to verify the address before you draft the letter. They will also provide information about any pending balance on the policy, depending on the cancellation date.

- Only the policyholder has the legal right to cancel an insurance policy. Only they can sign and address the policy cancellation letter.

- A proper business letter format is necessary for this document.

- Show courtesy and be firm while notifying the insurance company about leaving the policy.

- Request the insurance company to send a written confirmation that the cancellation is taking place.

- Mention that the insurer no longer has the authority to charge your bank or credit card for monthly premiums.

- Spell-check and proofread the policy cancellation letter before you make a printout. You should also sign the letter by hand. Create a copy of the cancellation letter for future reference.

- Use certified mail to mail your cancellation letter. It gives you a return receipt for complete satisfaction.

Insurance Policy Cancellation Letter Template

Are you wondering how to write an insurance cancellation letter? Here’s your template to get started;

Date:

Contact Person Name or Cancellation Department

Name of the Insurance Company

Insurer’s Mailing Address

Company’s City, State, ZIP Code

Re: Policy Number: #________

I am sending you this formal written notice to request cancellation of my insurance policy effective (mention cancellation date). It would be best if you could send me a written confirmation within 30 days to notify me that the cancellation is in effect. I request you refund the unused part of my policy premium and stop charging my bank account for monthly premiums.

Thank you for paying immediate attention to this matter.

Sincerely,

(Give your Signature)

Your Name

Insert Your Mailing Address

City, ZIP Code

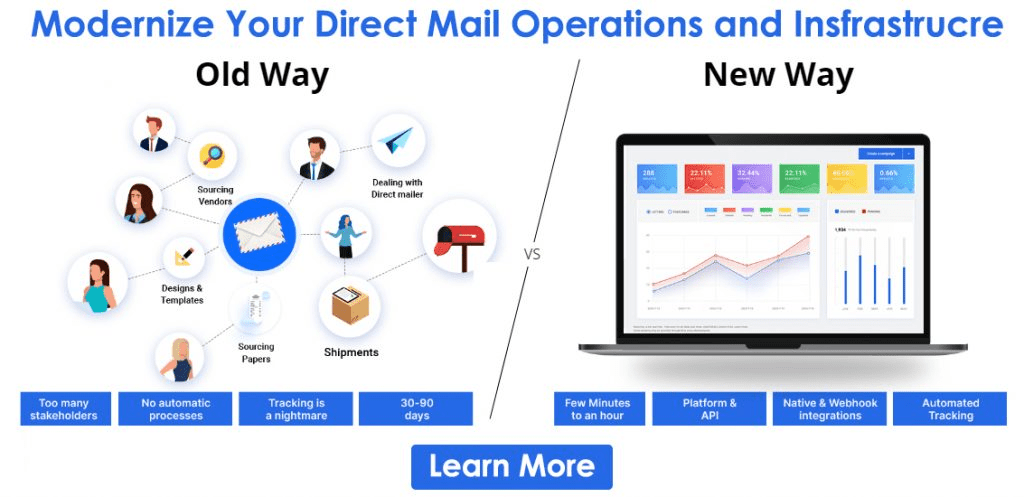

How Can PostGrid Help You Send Policy Cancellation Letters with Automation?

We understand that manually sending these critical documents could be hectic for a busy company. You need an automated solution that lets you send policy cancellation letters directly from your CRM system.

PostGrid’s direct mail API is an ideal solution for businesses that want to send such vital documents with streamlined workflows. The smooth integration capabilities let you define custom workflows for your mailing operations.

Sign up now to automate your policy cancellation letters.

| You may also want to read | |

|

1. |

How to Write a Demand Letter |

|

2. |

Geocoding API |

|

3. |

Promotional Materials for Print Marketing |

|

4. |

Canada Post Moving Address |

|

5. |

Canada Post Letter Size |

Ready to Get Started?

Start transforming and automating your offline communications with PostGrid