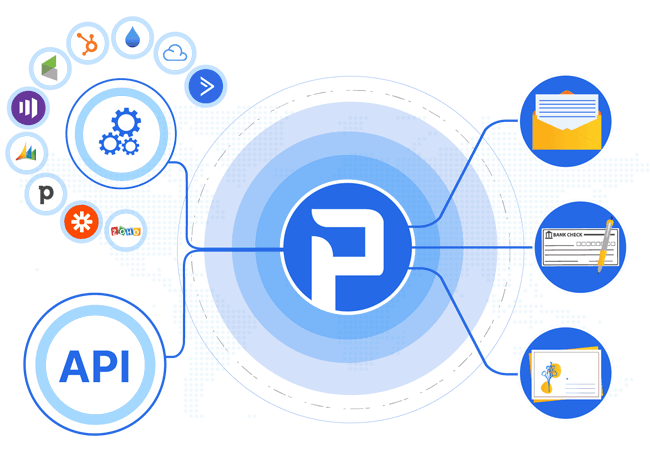

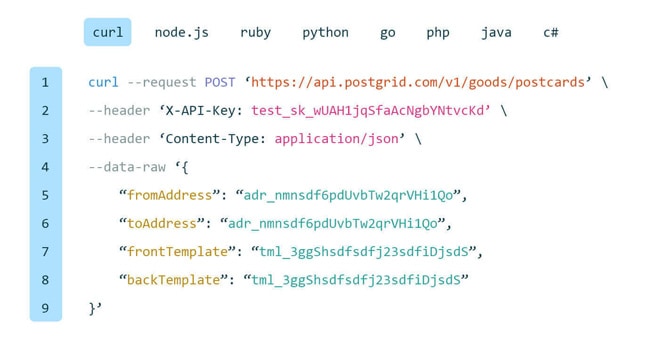

Use our fully-documented REST API to send personalized letters, cheques, postcards and improve address accuracy.

What PostGrid™ offers for companies

Print & Mail API:

- Automate print & mail with API Calls.

- Add capabilities to your existing CRM and enable sending letters, cheques, or postcards.

- Verify, complete, and standardize addresses to local postal standards in real time.

- Set up within minutes using our detailed API docs and test API keys.

Address Verification API:

- Autocomplete, Clean, Verify, and Standardise addresses to local postal standards.

- All our addresses are CASS and SERP certified ensuring a high delivery success rate.

- Bulk Verify – Upload and verify up to 200k addresses at a time.

- Set up within minutes using our detailed API docs and test API keys.

Your end-to-end

Offline Communication Solution

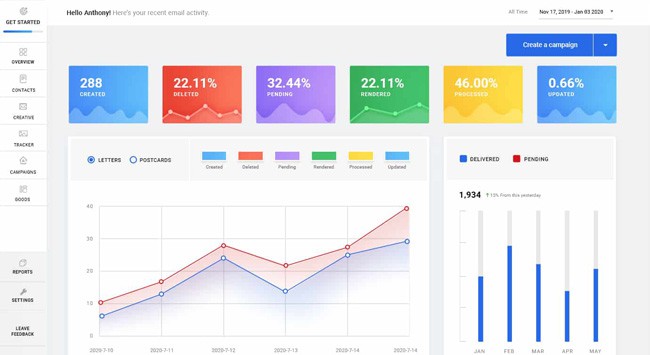

Automate Print & Mail

- Integrate print & mail functionality into your software using our fully documented REST API

- Empower your team to send personalized letters, postcards, and cheques without changing their existing workflows

- Connect over 1600 apps with PostGrid through Zapier to build your own automation pipelines

2-Day SLA

- All mail pieces are processed and handed over for delivery within two business days.

- Orders are routed to vendors closest to the destination to minimize delivery times.

Address Verification

and Validation

- Ensure deliverability of addresses across the US & Canada using our CASS + SERP certified Address Verification API

- Streamline address input at the point-of-entry using our Address Autocompletion facilities

- Correct malformed addresses to Canada Post and USPS standards without manual intervention

AI-Driven Address Parser

- Our multilingual freeform address parser can extract street names, city names, and more, enabling the verification of poorly formatted addresses

- We’re able to process thousands of addresses per second. Hence, large mailing lists can be verified and cleaned in seconds

Integrates with your favourite tech stack & tools

Easily improve your workflow and automate your offline process by integrating with your current stack

Ready to Get Started?

Start transforming and automating your offline communications with PostGrid